Smarter AI for Global Finance

Transforming decision-making with predictive, multilingual, and domain-aligned AI

Applied AI that works for financial institutions

01 / Quantitative Forecasting for Financial Planning

High-stakes environments require accurate foresight. SUTRA-Q—our suite of quantitative prediction models—enables financial institutions to anticipate market shifts, revenue fluctuations, and portfolio performance in real time.

Trained on multivariate time-series data, Q-Finance supports diverse prediction horizons, input granularities, and macroeconomic covariates. Whether forecasting cash flow, default risk, or trading volumes, Q models deliver precise, domain-specific outputs tailored to operational realities.

→ Liquidity risk forecasting

→ Scenario stress testing

→ Customer churn and lifetime value prediction

→ Treasury and ALM planning

→ Cross-asset price prediction

02 / Multilingual Intelligence Across Customer Touchpoints

SUTRA’s multilingual capabilities allow banks to communicate accurately and naturally with customers across 50+ languages. From KYC interactions to customer service automation, it ensures consistency and nuance—no matter the language, device, or regulatory environment.

SUTRA-V2 enables banks to scale communication globally while maintaining context relevance and interpretability.

→ Conversational banking

→ Multilingual document summarization

→ Email and chat triage

→ Cross-border compliance documentation

→ Virtual agents for financial services

03 / Domain-Specific Models for High-Speed Decisioning

SUTRA D3 distills the power of large foundational models into compact, high-performance AI tuned for finance. With D3-Finance, institutions can deploy real-time AI at scale—reducing latency, cost, and regulatory exposure.

From credit adjudication to transaction monitoring, D3-Finance ensures model performance remains consistent under dynamic workloads and tight audit requirements.

→ Automated underwriting

→ Intelligent risk scoring

→ AML pattern detection

→ Claims processing acceleration

→ Compliance document generation

04 / Enterprise-Ready Integration with AIRe

AIRe—the secure runtime platform that powers SUTRA—plugs directly into existing banking infrastructure. Modular by design, AIRe allows models to be deployed, updated, and governed without disrupting critical operations.

Whether through APIs or full AI orchestration, AIRe enables financial services teams to embed AI into every part of the organization, with enterprise-grade security, observability, and performance.

→ Modular deployment across cloud and on-prem environments

→ Support for real-time pipelines, agentic workflows, and batch processing

→ Integration with legacy core systems and modern data lakes

→ Policy enforcement and audit logging

→ Continuous model distillation using proprietary data

Where we work in Finance

01 – Retail & Commercial Banking

Deliver hyper-personalized financial experiences with predictive models and language intelligence tailored to every customer journey.

→ Dynamic pricing models

→ Next-best-action engines

→ Chat-driven onboarding

→ SME credit modeling

→ Loan origination AI copilots

02 – Risk & Compliance

Enhance transparency and control in risk frameworks with real-time reasoning and predictive analytics.

→ KYC / EDD automation

→ AML anomaly detection

→ ESG exposure modeling

→ Vendor risk prediction

→ Lineage-aware regulatory reporting

03 – Capital Markets

Enable quant and trading teams to build, evaluate, and deploy alpha-generating strategies with SUTRA-powered predictive and reasoning models.

→ Time-series financial forecasting

→ News-driven sentiment analysis

→ Trade strategy modeling

→ Portfolio drift detection

→ Event-driven scenario generation

04 – Wealth & Asset Management

SUTRA provides fund managers with 360° AI support—from portfolio diagnostics to investor communications—leveraging multilingual reasoning and real-time forecasting.

→ Personalized client reporting

→ Strategy explainability and audit

→ Fund performance summarization

→ Risk modeling for multi-asset products

→ Advisory assistant copilots

05 – Insurance & Claims

Accelerate the insurance value chain from underwriting to claims with SUTRA D3 models and Q predictions integrated into core workflows.

→ Claims triage and summarization

→ Premium pricing predictions

→ FNOL (First Notice of Loss) automation

→ Fraud signal detection

→ Policy comparison and rewriting

Finance in Action

Customer: Global Bank

Virtual Brand Ambassadors at Scale

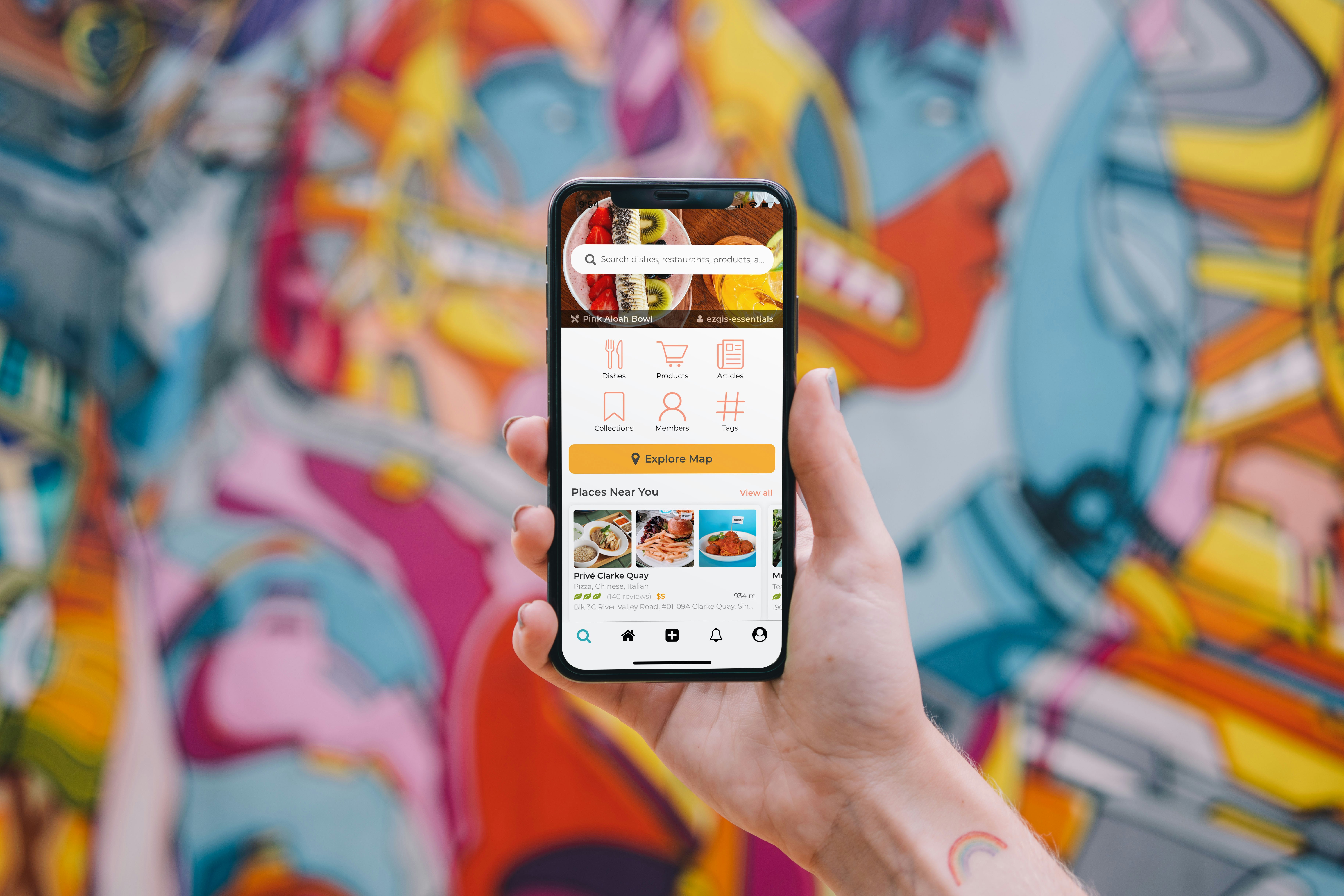

A global bank deployed SUTRA models to provide conversational banking experiences across mobile, web, and kiosk channels. Using semi-realtime avatars powered by AIRe, this bank now delivers consistent, multilingual support to millions, transforming customer engagement while reducing operational overhead.

Products:

→ AI Search

→ Multilingual Support Agent

→ Semi-Realtime Avatar